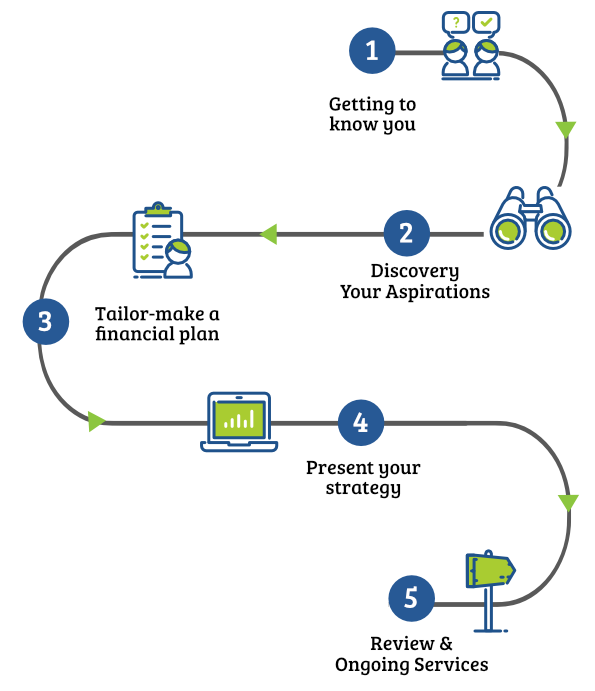

Getting to know you

Before your first appointment, we ask you to complete a questionnaire which you can find in the email that we sent to you. Completing and returning the questionnaire via the online portal ahead of the meeting will ensure that you can make the most of your time at the meeting, as the advisor will already be familiar with your financial and personal situation from looking through the questionnaire.

Discovery - Your Aspirations

At your first meeting, you may notice that our approach is a little different to other advisors’. You will meet with your Advisor and a second team member and the first meeting is all about getting to know you and to find out about your aspirations and your goals. It is easy for us to crunch the numbers for you, but in order to give you the right advice, we need to know what you want to achieve.

Tailor-make a financial plan for you

Our team will start working on your personal financial plan, depending on your situation and needs that can cover a variety of topics from Super and Investments to Estate Planning or insurance. We will prepare a Terms of Engagement for you which outlines our services and fee over the next 12 months. The document will be presented to you at your second meeting and you will then have the opportunity to take the document home and decide whether you wish to proceed with our service. Up until then, we do not charge you a fee.

Depending on your situation we may meet again before presenting the strategy to further discuss the details. You can feel confident that your details are handled confidentially by our highly skilled and experienced financial planning team. While you will have one advisor, you will find that the background work is completed by the whole team and you will likely meet a few of us. Our team is very compassionate and you can be sure that everyone has got your best interest at heart.

Present your strategy

Now we have enough information about your aspirations and circumstances, we have prepared a specific blueprint for your financial future including recommendations and structures designed to achieve your aspirations and objectives. Your advisor will discuss this blueprint in detail and answer all your questions. The plan will cover every relevant stage of your life and personal aspirations.

Review and ongoing services

The annual review process involves:

- Revisiting your aspirations & objectives to ensure they are still valid and have not changed

- Review the performance of the financial recommendations to ensure financial strategies are meeting expectations

- Review your investment risk profile because this may change as you learn from your experience and the education we provide on investing and managing financial affairs

- Reviewing any changes to governing legislation, which will impact on your financial plan now and in the future

- Discussing your current lifestyle needs and checking that the financial plan is meeting these needs

- Reviewing your insurance protection needs to ensure they are adequate to your changing circumstances

- Updating you on change markets across different world economies & the effect these might have on your plan.

- Coaching you through uncertain times and educating you through the process.